To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million. Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18. The debt-to-equity ratio is one of several metrics that investors can use to evaluate individual stocks. At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance on debt. It shows the proportion to which a company is able to finance its operations via debt rather than its own resources.

- Yes, the ratio doesn’t consider the quality of debt or equity, such as interest rates or equity dilution terms.

- Overall, D/E ratios will differ depending on the industry because some industries tend to use more debt financing than others.

- Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times.

- As is typical in financial analysis, a single ratio, or a line item, is not viewed in isolation.

- For startups, the ratio may not be as informative because they often operate at a loss initially.

Debt-to-EBITDA Leverage Ratio

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Debt-to-Equity Ratio, often referred to as Gearing Ratio, is the proportion of debt financing in an organization relative to its equity. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience.

What Does a Leverage Ratio Tell You?

A low debt to equity ratio means a company is in a better position to meet its current financial obligations, even in the event of a decline in business. This in turn makes the company more attractive to investors and lenders, making it easier for the company to raise money when needed. However, a debt to equity ratio that is too low shows that the company is not taking advantage of debt, which means it is limiting its growth. Understanding the debt to equity ratio is essential for anyone dealing with finances, whether you’re an investor, a financial analyst, or a business owner. It shines a light on a company’s financial structure, revealing the balance between debt and equity. It’s not just about numbers; it’s about understanding the story behind those numbers.

What Does a Company’s Debt-to-Equity Ratio Say About It?

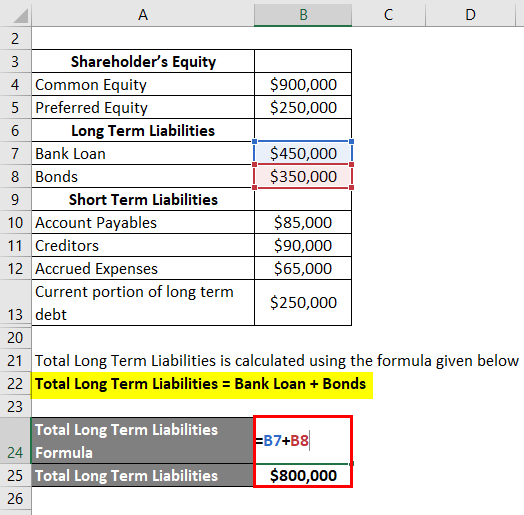

In other industries, such as IT, which don’t require much capital, a high debt to equity ratio is a sign of great risk, and therefore, a much lower debt to equity ratio is more preferable. The lender of the loan requests you to compute the debt to equity ratio as a part of long-term solvency test of the company. Since debt to equity ratio expresses the relationship between external equity (liabilities) and internal equity (stockholders’ equity), it is also known as “external-internal equity ratio”.

The lower the ratio result, the more debt a company has used to pay for its assets. It also shows how much shareholders might receive in the event that the company is forced into liquidation. The weighted average cost of capital (WACC) can provide insight into the variability of a company’s D/E ratio. The WACC shows the amount of interest financing on the average per dollar of capital. It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good. Additionally, the ratio should be analyzed with other financial metrics and qualitative factors to get a comprehensive view of the company’s financial health.

Instead of using long-term debt, an analyst may decide to use total debt to measure the debt used in a firm’s capital structure. In this case, the formula would include minority interest and preferred shares in the denominator. To compensate for this, three separate regulatory bodies—the FDIC, the Federal Reserve, and the Office of the Comptroller of the Currency (OCC)—review and restrict the leverage ratios for American banks.

Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1). It’s also helpful to analyze the trends of the company’s cash flow from year to year. You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing. However, it’s important to look at the larger picture to understand what this number means for the business. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing. You can find the balance sheet on a company’s 10-K filing, which is required by the US Securities and Exchange Commission (SEC) for all publicly traded companies.

For example, capital-intensive industries rely more on debt than service-based firms, so they would expect to have more leverage. To gauge what is an are you delivering potentially shippable product each sprint acceptable level, look at leverage ratios across a certain industry. It’s also worth remembering that little debt is not necessarily a good thing.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

Attributing preferred shares to one or the other is partially a subjective decision but will also take into account the specific features of the preferred shares. Publicly traded companies that are in the midst of repurchasing stock may also want to control their debt-to-equity ratio. That’s because share buybacks are usually counted as risk, since they reduce the value of stockholder equity. As a result the equity side of the equation looks smaller and the debt side appears bigger. This ratio compares a company’s equity to its assets, showing how much of the company’s assets are funded by equity. Not only that, companies with a high debt-to-equity ratio may have a hard time working with other lenders, partners, or even suppliers, who may be afraid they won’t be paid back.