Analysis that defines the moment of change in the stock trajectory for good

Analysis that defines the moment of change in the stock trajectory for good

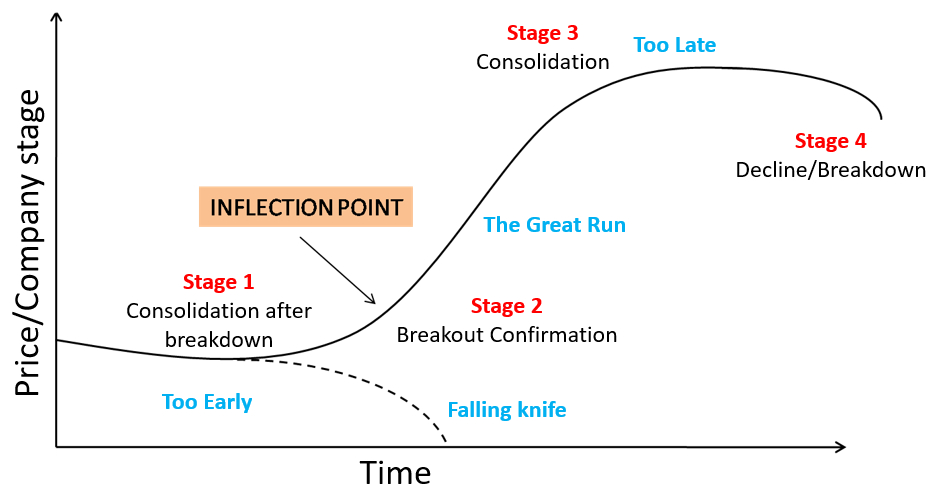

Refers to the point at which a trend makes a U-turn or ACCELERATES in the direction its going

Know the rules carefully before getting into the game

The right way to participate or even test the power of MIPA is to stay invested in strategy for little longer period say 6 to 12 months.

© Mint Investing All rights reserved. All other trademarks and trade names are properties of their respective owners.

WhatsApp us